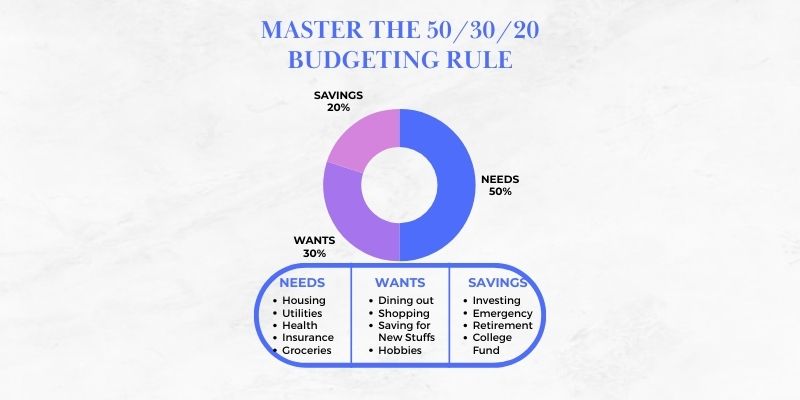

The 50-30-20 rule is the simplest way to allocate the money you want to spend on yourself or household items. According to the rule, 50% of your budget will be spent on things that are necessary to you, 30% on those items that will make your life good, although you don't need these items, and 20% will be saved for your future, like putting money into retirement or saving accounts to pay your debts.

It's not a hard and fast rule you must follow, but guidelines to help you allocate your money wisely. This will allow you to make the right decisions and enjoy your life peacefully. By knowing how you manage your money, you will be on the right track to achieving your financial goals.

Make your 50-30-20 financial budget

A monthly budget helps you achieve your long-term and short-term goals; the 50/30/20 rule will help you make a budget. Start with the income you must pay first, in the form of taxes, basic needs, and the things that will make your life comfortable.

50% on mandatory expenses

After understanding your income, look for bills you must pay, such as phone, gas, electricity, water, rent, mortgages, and car bills. Estimate how much you need for groceries each month. Groceries are your primary need. Sum up all this and find out what your income already makes, according to the 50-30-20 budgeting rule.

If the budget is less than 50% of the income, figure out what you are missing: bills or groceries. And if it is more than half the income, question where you can reduce it. Have you included an extra beverage? Do you need to rent a car or not? How much money do you have to pay when you park that car?

30% on your Wants

Wants are those items that are not essential for you but that you want them to have in your life, like buying tickets to watch movies when you can watch them at home. These items are optional if you consider them for a moment; for example, you can purchase home food instead of ordering junk food, perform work out within the house instead of paying for the gym, or watch your sport on TV instead of going to the stadium.

This section of the budget includes upgraded decisions in your life, like buying a Lamborghini instead of an economical car, watching a movie at home, or going to the cinema to watch a big-screen film. Wants are those extra things that make your life entertaining and enjoyable. For buying extra jewelry or clothes,

20% on Savings

The last 20% of your budget would be used to pay off debt and save retirement money. It would not be easy to save money when you start, but you must push yourself to save money for the future. Pay off your student loans and credit card debts because these are the debts on which you have to pay high interest.

High debt can be a massive hindrance to achieving your financial milestones. After paying off debts, you can put the remaining 20% in your savings account. According to many financial experts, you should have savings of at least the next six months, which you can use in an emergency. For long-term saving plans, you can consider IRAs.

How to adopt the 50-30-20 budget rule

- Make a list of your expenses: List down all these expenditures of a month, keeping in mind your spending habits. Understanding your financial habits will help you follow the 50-30-30 budgeting rule. You can use Microsoft Excel to make a list of your expenses.

- Know your income: Understand how much money you earn monthly and your net income after paying off all taxes. Allocate the accurate amount to each budgeting category according to your income.

- Figure out non-negotiable costs: These are the basic costs that you need for survival, like utility, insurance, rent, transportation, and grocery bills. Be careful while allocating funds for these expenses.

- Set up a savings account: To invest your savings, create a savings account to put in your monthly savings. After paying off debts, start increasing the money for your retirement savings, and consistently review your budget to adjust it according to your financial goals and lifestyle.

An Example of 50-30-20 rule

After paying taxes, Alex has $5,000 a month; if he follows 50-30-20 budgeting, this is what his monthly expenses can look like:

50% for basic needs:

- $1,250 for Mortgage

- $700 for groceries

- $225 for Car fuel/rent/insurance

- $150 for electricity bills

- $100 for gas bill

- $75 on internet and phone bill

Total = $2,500, or 50%

30% for personal comfort:

- $600 for outside eating

- $450 for shopping

- $300 for sports events and movies

- $150 for Cable TV and streaming

Total = $1,500, or 30%

20% for future savings:

- $700 as emergency fund

- $300 in Roth IRA

Total = $1,000, or 20%

Benefits of the 50-30-20 budget rule

Simple to Use

Making a budget using 50-30-20 rules is relatively straightforward. You can efficiently distribute your income without worrying about performing minor calculations. A simple layperson who doesn't know the financial market can also follow this role.

Efficient money management

The 50-30-20 rule helps you manage your income better by offering an easy-to-follow budget. Using it, you can ensure that all of your monthly expenses are covered, you have enough left to spend on your comforts, and you can save for retirement, too.

Prioritization of basic needs

By following a budget, you can cover your necessities without overusing income or borrowing money to fulfil vital expenses. Half of your budget will go to your needs, which provides satisfaction that essential life needs will likely be covered.

Savings for emergency

You can allocate 20% of your budget into savings for retirement or in an emergency. You can pay debts and fulfil your retirement goals. By consistently allocating money in savings, you can accumulate enough money for your future.