-

Mortgages

MortgagesAll You Need To Know About Pros And Cons Of Debt Management And How It Affects Your Financial Situation

Using a debt management plan to decrease the effects of interest rates on your credit cards and as a means to reduce the payments you make in a month. There are companies working for this purpose specifically. They devise a debt management plan for you after understanding your financial situation to help you get rid of your unsecured debt. To quote a few examples, we can consider medical debts, debts due to interest rates of credit cards, or more general type, consumer debts are considered under this category.

Feb 08, 20244004 -

Know-how

Know-howDrivewise Program with Allstate

Allstate Drivewise keeps track of your driving behaviors and awards you a discount depending on how safely you navigate the roads. Some watched behaviors include your top speed, how hard you brake, and what time you drive.

Feb 05, 20241486 -

Investment

InvestmentBest Investing Strategies On How Income Stocks Generate Profits

Read our comprehensive guide to investing strategies: how income stocks make you money.

Feb 05, 20249414 -

Investment

InvestmentHow to Compare Universal Life Insurance: Key Factors to Consider

Compare universal life insurance policies with our guide. Understand features and benefits for informed decisions.

Feb 05, 20248999 -

Investment

InvestmentWhy a Diamond Engagement Ring Is Not a Good Investment

While symbols of love such as engagement rings have become customary in some cultures, this article looks into why you may want to invest your money in other ways.

Feb 04, 20244945 -

Know-how

Know-howEight Key Factors to Consider When Choosing Your Business Location

This essential guide explores eight key factors to consider when choosing a business location, helping you make smart, strategic decisions for your business's success.

Feb 03, 20242421 -

Know-how

Know-howWhat You Should Know about Insurance for a Learner's Permit

it’s natural for parents to have some trepidation about their teen applying for their first learner's permit, even though this is a significant developmental milestone. An adolescent's first few times behind the wheel are always fraught with uncertainty. Although the risk of an accident is highest just after a teenager starts driving alone for the first time, this does not make the authorization period risk-free.

Feb 02, 2024845 -

Investment

InvestmentLearn About: What Is a Mutual Fund Family?

All the individual funds under a single investment firm's management are collectively referred to as the fund family. One such group would include Vanguard's mutual funds. Investors can reap diversification benefits, including lower costs and sales charges, access to research and investment advice, and more, by spreading their money across multiple funds within the same family.

Feb 01, 20243791 -

Investment

InvestmentSecurian Life Insurance in 2024: An Expert Review and Evaluation

Securian Life Insurance offers cheap term life insurance that may be permanent. The minimum and maximum death benefits of term life policies aren't made public. Read more.

Jan 29, 20248371 -

Know-how

Know-howExplain: What is a Salary Sacrifice For Pension

If you are considering making a salary sacrifice for pension contributions, check with your employer and financial advisor to ensure it is right for you. It can be a great way to save for the future, but you must understand the implications before deciding.

Jan 23, 20241770 -

Know-how

Know-howDifferences Between General And Professional Liability Insurance

Although their similarities, general and professional liability insurance protects against small businesses' common liabilities. The risks you face will determine which, if either, of these policies you need to buy

Jan 22, 20247402 -

Investment

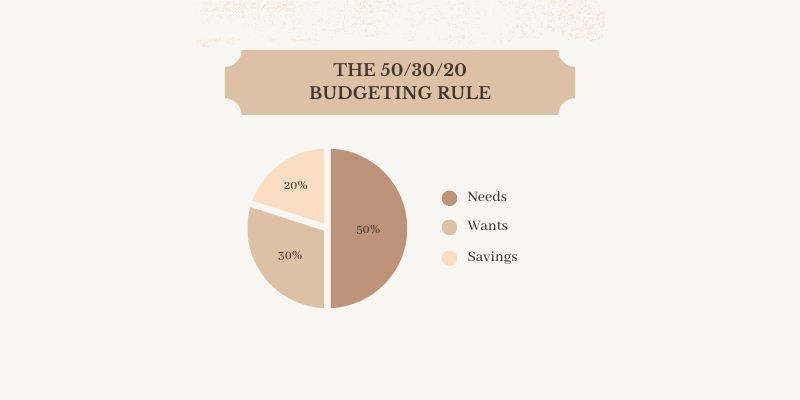

InvestmentDo You Know: How to Kill Your Fear of Debt?

Dealing with debt is never easy, but it doesn't have to be impossible. With the right mindset and some helpful tips, you can face your fear of debt and take control of your finances. Start by understanding what causes the anxiety first, then use strategies such as budgeting and consolidating debts to make things easier to manage.

Jan 21, 20249007 -

Know-how

Know-howTips For Buying On Amazon.Com

Amazon.com, Inc. has had incredible success and is now the market leader in online shopping. It began with selling books but rapidly branched out into selling other types of merchandise.

Jan 18, 20247607 -

Know-how

Know-howHow Form 843 Can Help You Claim Your Refund and Request for Abatement

Learn how to navigate and utilize IRS Form 843 in case of overpayments or unjust charges. This guide provides steps to fill out the form and potential pitfalls to avoid.

Jan 09, 20249156 -

Investment

InvestmentHow Black Friday and Thanksgiving Affect Stock Prices

Taking additional days off for Thanksgiving or Christmas can have an impact on the stock market. The day before a holiday or a long weekend, known as the holiday impact or the weekend effect, the markets typically experience increased trading activity and higher returns.

Jan 08, 20249404 -

Investment

InvestmentWhat Is DEMAT (Dematerialization)? What You Need To Know

Dematerialization refers to the act of converting your physically held shares and securities into their corresponding digital or electronic versions. The primary objective is to make it less difficult to purchase, sell, transfer, and keep shares, as well as to reduce transaction costs and the likelihood that anything will go wrong.

Jan 05, 20249500 -

Investment

InvestmentMotorcycle Insurance Demystified: A Comprehensive Guide to Coverage

Explore the complexities of motorcycle insurance, understand various types of coverage, factors affecting rates, and tips for choosing the right insurance policy

Dec 30, 20233264 -

Investment

InvestmentHow Much Do Day Traders Make

Looking to make more money as a day trader? Read on to find out the different factors that affect how much money you can make and the resources available to help.

Dec 29, 20234398 -

Investment

InvestmentUnderstanding Agency Bonds: From Basic Definitions to Tax Regulations

Explore the intricacies of agency bonds in this comprehensive guide. Learn about their types, tax rules, pros and cons, and how they fit into a diversified investment portfolio.

Dec 28, 20237044 -

Know-how

Know-howUnderstanding SEC Release IA-1092: Historical Context and Impact

Building on SEC Release IA-770, SEC Release IA-1092 updated the investment advisor (IA) model. Read more.

Dec 25, 20232178 -

Know-how

Know-howMastering Accrual accounting with Confidence

Explore the perks, difficulties, examples, and workings of Accrual accounting. Get ready to take your accounting knowledge to the next level!

Dec 23, 20234765 -

Know-how

Know-howUse Whole Life Insurance To Get Cash Fast: 9 Strategies

Money is what I want, and that's why the phrase "I need money" has been chanted for over 50 years. There are several options for owners of whole life insurance to access "a whole lotta money." Here's how the wealthiest one percent of the population puts life insurance to work for them

Dec 22, 20234934 -

Mortgages

MortgagesA Detailed Review of Iowa Student Loans

Learn more about the Iowa Student Loan, including the lender's services, financing options, mortgage rates, qualification criteria, and many more.

Dec 22, 20238696 -

Know-how

Know-howAn Essential Guide to Know: What Are Financial Derivatives?

A derivative is a financial contract whose value is tied to the performance of another asset, group of assets, or benchmark. Derivatives are agreements between three or more parties that can be traded publicly or privately (OTC). Each asset class has its risks that can be hedged with these contracts. The movement of the underlying asset determines the price of a derivative..

Dec 13, 20238101 -

Investment

InvestmentFactors Influencing Stock Prices in Companies: A Detailed Study

Learn what drives a company’s stock price and why it is essential to understand factors from economic conditions to company performance before investing.

Dec 12, 20234111 -

Know-how

Know-howEarned Income Before Age 66 or 67

Your life expectancy and marital status, among other things, will significantly influence the amount of money you will eventually get as a monthly benefit from Social Security. If you plan to retire at 62, you should consider whether or not you would prefer to continue working beyond that age. Consider, as well, how strongly you feel the need to guard the buying power you had at that time.

Dec 08, 20232290 -

Know-how

Know-howThe Theory and Reality of Trickle-Down Economics

This document provides an in-depth exploration of trickle-down economics, dissecting its theoretical basis and real-world implementation. It discusses the impact of such economic policies on different sectors and compares their application across various global contexts.

Dec 07, 20236031 -

Know-how

Know-howAnalyzing Infinity Insurance For 2023

Infinity car insurance may be a good choice for drivers rejected by more traditional insurance providers. Therefore, people who have been turned down for vehicle insurance elsewhere due to issues like a DUI conviction, a poor driving record, or an excessive number of claims may get coverage with Infinity.

Dec 05, 20235196 -

Investment

InvestmentHow Do ETF Dividends Work?

Many exchange-traded funds (ETFs) generate income through the ownership of dividend-paying shares, whereas index-tracking and growth investing are the most prevalent uses of ETFs. Owners of ETFs receive their quarterly dividends, which are collected and dispersed. Dividends can either be paid out in cash or reinvested in the ETFs' underlying shares.

Dec 05, 2023487 -

Mortgages

MortgagesWhat Is a Hard Money Loan?

A loan from a private lender secured against a physical asset, such as real estate, is a hard money loan. Do you know hard money lenders how does it work?

Dec 01, 2023890 -

Know-how

Know-howAll You Need to Know About Tracking Net Worth Using a Net Worth Calculator

Let’s unlock the true measure of your financial health with our guide to understanding and calculating your net worth. Learn the secrets to growing your assets.

Nov 29, 20237523 -

Mortgages

MortgagesRent-to-Own Car: How the Process Works

Rent-to-own cars require you to pay a monthly fee to the dealership. You'll own the vehicle at the end of your rental term if you keep up with your payments. As long as you have a good credit score, you'll be qualified for rent-to-own financing, and you'll own your automobile after the term. It's possible that you won't get a warranty or improve your credit rating if you rent instead of buying

Nov 25, 20232762 -

Know-how

Know-howUnlocking Success: A Guide to Choosing the Right Copy Trading Platform

Discover the power of copy trading! Uncover the best platform for your investment goals. Maximize profits with informed choices. Dive in now!

Nov 21, 20232753 -

Investment

InvestmentDecoding Preference Shares: A Simplified Exploration into the Universe of Preferred Stock

Embark on a journey to demystify preference shares and explore the nuances of various preferred stock types. This guide, stripped of financial jargon, is designed to make complex investment concepts accessible to all, unraveling the intricacies of these unique financial instruments.

Nov 18, 20236197 -

Know-how

Know-howHow Are They Different? Comparing Mobile, Manufactured, And Modular Homes

Do you know which manufactured or modular home would win in a competition? Understanding the critical distinctions between the two housing options is in your best interest. Although manufactured and modular homes are examples of prefabricated structures, they are fundamentally different options that should be discussed separately. To make an educated choice, we've enlisted the aid of industry professionals in defining the distinctions between manufactured and modular houses.

Nov 17, 2023409 -

Taxes

TaxesEverything You Should Know about Turbotax

In comparison to competing products, TurboTax is more expensive. Some TurboTax customers may find the experience and the availability of human aid to be worth the additional expense, even if they don't require all the bells and whistles that most TurboTax online packages offer. We have long lauded TurboTax's interface and usability.

Nov 15, 20232050 -

Investment

InvestmentWhat Is a Series HH Bond?

The Series HH bond was noncommercial for 20-year. And it is a U.S. government investment bond that accrues semi-annually.

Nov 14, 20232700 -

Mortgages

MortgagesDefault Mortgage 101 - Buying a Home after Foreclosure Best Tips

It is not the end of the world when you are at the stage of buying a home after foreclosure. Read the article to know more about how you can turn things around

Nov 11, 2023957 -

Investment

InvestmentAuthorized Investor Defined: Recognize The Requirements

The Securities and Exchange Commission defines "accredited investors" as some of those people who are financially stable enough to invest in "sophisticated" securities. Accreditation is only granted to those who meet specific requirements, such as making over $200,000 per year on average or working throughout the financial sector. Unauthorized securities may only be sold the "accredited investors," who are those with sufficient wealth to assume the associated responsibilities. Accredited investors meet one or more of the following criteria involving annual income, personal wealth, asset size, governance practices status, or professional expertise to purchase and invest in unregistered securities. For investors, the absence of information that comes with SEC registration makes unlisted stocks more dangerous

Nov 02, 20232160 -

Know-how

Know-howU.S. Poverty Rate

The federal poverty threshold measures poverty levels in the United States. The number of people in the United States who are considered to be living in poverty is determined on an annual basis by the United States Census Bureau.

Oct 23, 20236754 -

Know-how

Know-howDifferent features of Total Assets (ROTA)

Return on total assets, often known as ROTA, the total net assets of that company

Oct 22, 20237042 -

Know-how

Know-howOption For Your Car Insurance

You can temporarily withdraw from a policy, suspend, cancel, or reduce the amount of coverage you get.

Oct 21, 20233903 -

Investment

InvestmentWhat Is an Investment? A Complete Guide

Investing entails spending money to get a greater return later on. Stocks, bonds, and mutual funds are obvious examples of investments, but real estate, works of art, antiques, and perhaps even wine are also sometimes included. Although there is always the chance of loss when putting money into the stock market, many people throughout the globe have reaped substantial rewards from taking calculated risks.

Oct 10, 20239958 -

Know-how

Know-howHow the TV Advertising Industry Works

Television advertising is not on the edge of extinction, but rather, the television ad business model is changing. However, things have changed drastically since Mad Men's advertising era, in which a single T.V. commercial might change the world—or at least turn around a company's sales numbers—and this year's Super Bowl is no exception.

Oct 07, 2023722 -

Mortgages

MortgagesNew York City Mortgage Lenders

Are you looking for a mortgage lender in the New York City area? Following extensive research, we have selected the top lenders in the city based on their performance in five criteria.

Oct 03, 20232251

-

Taxes

TaxesReal Estate Taxes and Property Taxes: Difference

Feb 22, 2024 -

Mortgages

MortgagesUsing Collateral Loans to Borrow Against Your Assets

Feb 16, 2024 -

Investment

InvestmentWhat Is Options Theta: Explain in Detail

Feb 15, 2024 -

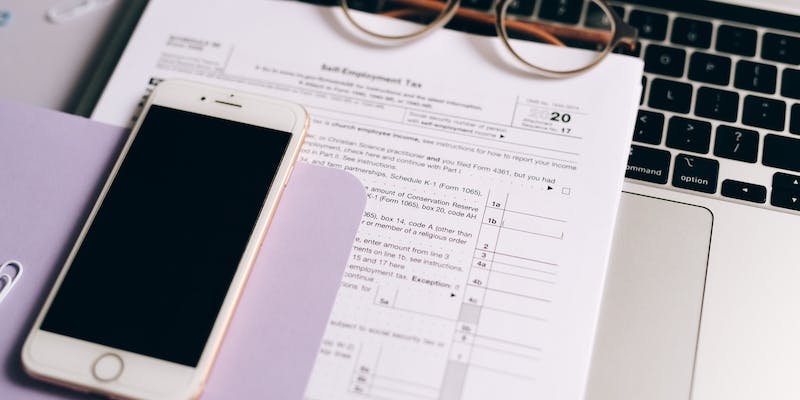

Taxes

TaxesSelf-employment Tax 2022 (Social Security and Medicare Taxes)

Feb 12, 2024 -

Mortgages

MortgagesPaycheck Protection Program PPP Loans

Feb 12, 2024