The value of what you have less your obligations, or everything you possess less everything you owe, is your net worth. Taking stock of your personal wealth is similar to issuing a credit card to yourself. You can identify what is and is not working in the world of money by adding out all of your financial possessions and obligations. In this article, we will explain how you can track your net worth using a net worth calculator. Let’s move forward!

Calculating Net Worth: What are Assets and Liabilities?

Here are some principles to help you identify assets and liabilities if you're unsure:

Assets

Money you can easily access, like in your checking or savings accounts, and investments you can sell quickly, such as stocks and bonds, are your assets. People sometimes call them liquid assets.

When determining your net worth, you may include fixed assets if they can be liquidated when necessary. For instance, your house could contribute to your net worth if you are willing to sell it or use it as collateral for a loan.

Liabilities

This category is all about the money you owe to others. It includes things like credit card balances, payday, auto, personal, and title loans—basically any debt you have. Even the mortgage on your house counts if you're using the house as part of your assets.

How to Use the Net Worth Calculator?

It is advised to enter information that truly represents the value of your financial assets and liabilities in order to get the utmost out of the net worth calculator.

Understanding Your Assets

To use this calculator and figure out your net worth, you need to know how much your main assets are worth. An asset is anything you own that can be sold for money. This includes not just investments like stocks and bonds but also your house, car, and even the cash in your bank account.

Some assets can be sold quickly and at their current value because they're easy to understand. Cash is the best example—it's very easily converted. But not all assets are as easy to turn into cash. Some take more time and effort to sell, and there's a risk you might not get the full expected amount.

Just tell the advisor how much you think each type of asset is worth if you were to sell it today. Don't stress about any outstanding debts like mortgages or auto loans for now. They'll handle those in the "Your Liabilities" section.

Annual Asset Growth Rate

Figuring out the yearly growth rate of your assets can be tricky. The calculator simplifies it by showing the total worth of four main asset classes: cash, investments, personal property, and real estate.

Picking one overall yearly growth rate is tough because each of these could have very different annual returns. The default growth rate in the calculator is set at 7%, which represents a reasonably cautious estimate, especially for real estate and stock-heavy investments. If you have assets with poor or no returns, you might want to adjust this rate to even lower.

Understanding Your Liabilities

Your debts are like the downside of your financial sheet—your liabilities. Just tell the advisor how much you owe for each type of responsibility in the calculator. They'll take care of the rest.

Some liabilities can turn into assets over time. For example, as you pay off your mortgage, you build equity in your house. On the flip side, with things like credit card debt, settling the liability just means you don't owe that money to the company anymore. It's a bit like transforming some debts into assets while others just disappear.

Annual Liability Growth Rate

Calculating the yearly growth rate of your debts can be just as tricky as it is for your assets. Loans like mortgages or auto loans have fixed terms and interest rates you agreed to beforehand. Others, like credit card debt or student loans, can be more unpredictable. If you're making small, irregular payments or continuously adding to your debt, your liabilities might keep growing. It's a bit like navigating a maze where some paths are clear, but others are a bit hazy.

If you're making regular payments on your home and vehicle loans as per the loan agreement, your obligation growth rate should be zero—it's steady and planned. Similarly, if you're paying off your credit card balance monthly without adding more, that growth rate should be zero, too.

But, if you have credit card debt or student loans that you're not chipping away at regularly, you'll need to factor in the cost of borrowing and the amounts involved to get an accurate idea of the obligation growth rate. It's like making sure all the pieces fit together for a clear picture.

How To Increase Net Worth?

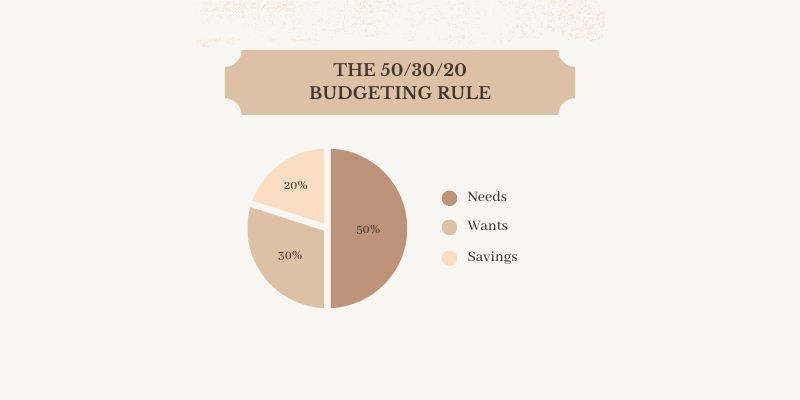

Your net worth can be raised in a variety of ways. One way is to invest in assets that have the potential to appreciate in value, such as stocks or real estate. Getting rid of debt is another method.

You are growing your assets when you choose option number one and minimizing your obligations when you choose option number two.

You may also raise your net worth by

- Making additional savings.

- Reducing your expenses.

- Expanding the sources of income.

No matter how you decide to raise your net worth, maintaining your success will need constant work. Either you will need to ensure that your income increases while your debts stay the same, or you will need to find ways of making sure that you aren't putting on additional obligations than you have.

The Bottom Line!

Net worth gives you the real picture of someone's or a company's wealth. Just looking at assets alone can be misleading because often debts can outweigh them. The key is to grow assets while trimming down debts and other commitments, and that's how you boost your net worth. If you want to dive deeper into calculating your assets, give this article a thorough read!