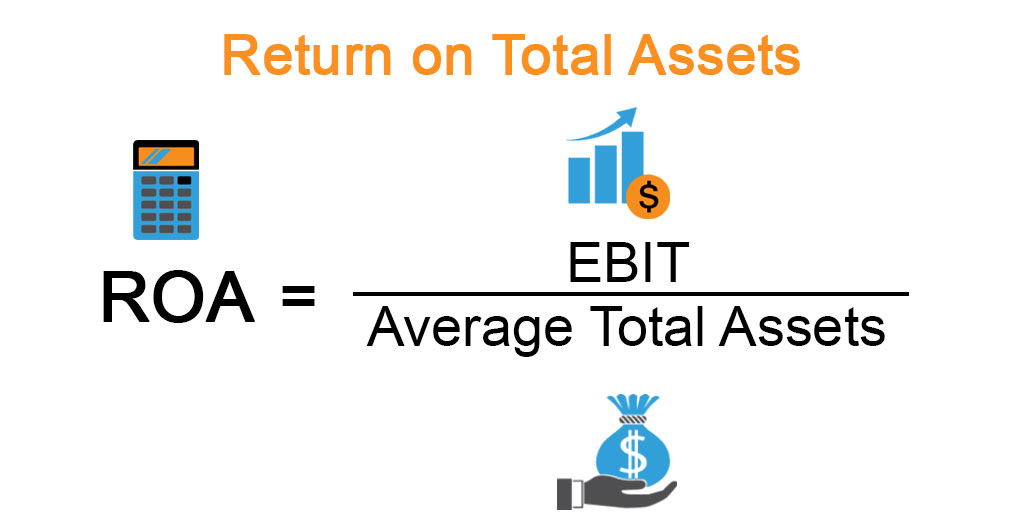

It is the ratio between a company's net income and its total average assets a company receives in a financial year compared to the average of that company's total assets. It is the ratio between a company's net income and its total average assets. Generally, the ratio is a good measure of the efficiency with which a firm uses its assets to create profits. EBIT is used instead of net profit to ensure that the emphasis of the statistic remains on operational results rather than being swayed by variations in taxation or financing compared to other businesses in the same industry.

How to Calculate Return on Total Assets

When a firm's profits are bigger than its assets (and the greater the coefficient that results from this calculation), it is argued that the company is utilizing its assets more efficiently. The ROTA indicates how much money is earned from each dollar put into the organization and may be stated as either a percentage or a decimal.

Because of this, the organization can observe the link between its resources and revenue, and it may also give a point of reference to establish whether or not it is utilizing its assets more efficiently than it did in the past. The ROTA is stated to be one or one hundred percent when the conditions are such that the business generates a new dollar for every dollar invested. The calculation for ROTA, which stands for return on total assets, is as follows:

To determine ROTA, divide annual net income by either the average total assets over a particular year or the total assets over the most recent twelve months if the latter data set is available. Another way to express the same ratio is to think of it as the product of the profit margin and the turnover of all assets.

ROTA Formula

To compute ROTA, collect the number for a company's net income from its income statement and then add back any interest and taxes paid throughout the year. The EBIT of the firm may be determined from the resultant figure. After that, you should divide the EBIT figure by the total net assets of the firm to display the profits the company has produced for each dollar of assets it has recorded in its books.

To compute this ratio, total assets include contra accounts, meaning that an allowance for questionable accounts and cumulative depreciation are removed from the total asset balance before the ratio is calculated. The ROTA indicates how much money is earned from each dollar put into the organization and may be stated as either a percentage or a decimal.

Use of Return On Total Assets (ROTA)

The value of an item may go up or down during its ownership. Regarding real estate, the item's value has a chance of going up. On the other hand, the value of most mechanical components of a company, like automobiles and other equipment, often decreases over time due to normal wear and use on the assets.

Because the ROTA method utilizes the book values of assets from the balance sheet, it may greatly underestimate the true market value of the fixed assets. This is because the ratio is higher than it should be. The ratio's applicability to financed assets presents still another constraint to its use. Suppose a loan was utilized to purchase an asset. In that case, the ROTA could be advantageous, even if the firm might be having problems meeting its interest cost payment obligations.

Adjustments may be made to the ratio inputs so that they accurately represent the functional values of the assets while also considering the interest rate presently being paid to a financial institution. Another example would be if an item were purchased with funds from a gift with no interest rate. Because many younger firms have larger levels of debt concerning their assets, these modifications may cause the company to seem less appealing to investors. This is because of the correlation between debt and assets. As soon as those loans start to be paid off, the ROTA will give the impression of improving proportionately.

Financial Leverage

To carry out an investment or a project, one might use leverage by borrowing money, also known as debt. The effect of this is to make the prospective rewards from a project more valuable. If the investment does not provide the desired results, the potential negative risk will be multiplied due to leverage. If a business, a piece of property, or investment is "highly leveraged," it indicates a greater debt than equity.

Both corporations and investors use the idea of using leverage. Leverage is a financial tool that lets investors dramatically boost the profits generated from an investment. They increase the potential return on their assets by using various financial products, including margin accounts, futures contracts, and options. Leverage is one method that businesses may utilize to finance their assets.